Disciplinary Newsletter March 2025

Disciplinary Newsletter

March 2025

Volume 14 Edition 1

IN THIS ISSUE

Introduction

Detailing Investigations

Publishing Disciplinary Decisions

Public Initiated Investigations

Case #1: Failure to Verify Information Resulting in Misleading Advertising

Case #2: Not Protecting Interests of Clients and Unprofessional Conduct

Case #3: Misleading Advertising/Failure to Discover Facts

Case #4: Releasing Deposit Without Written Authority

Case #5: Not Making Required Disclosures

Case #6: Lack of Knowledge/Skill/Judgement and Failure to Discover Facts

Case #7: Unprofessional Conduct During A Viewing

Case #8: Not Protecting Interests of Client

NSREC Initiated Investigations

Case #1: Undisclosed Criminal Charges/Convictions

Case #2: Misleading Advertising

DETAILING INVESTIGATIONS

The Disciplinary Newsletter does not detail every case the Commission investigates. Rather, these cases were found to be the most useful as a learning resource.

PUBLISHING DISCIPLINARY DECISIONS

The Commission Disciplinary Newsletter publicizes decisions in accordance with the Commission by-law 839.

PUBLIC INITIATED INVESTIGATIONS

CASE #1: FAILURE TO VERIFY INFORMATION RESULTING IN MISLEADING ADVERTISING

Buyers purchased a residential home and an adjacent lot. The adjacent lot was a 1.5-acre wood lot, which was advertised as an approved building lot. As part of their retirement income, the buyers planned to build rental properties on the lot. When they applied for the building permit, they were told by the respective municipality that rental units could not be built on this lot. The buyers submitted a complaint to the Commission alleging that the seller’s licensee falsely advertised the property as an approved building lot.

The evidence supported that at the time of listing, the sellers advised their licensee that the adjacent lot was an approved building lot. The licensee did not confirm this information with the municipality prior to advertising. During the seller’s ownership of the property, the approved land use of the lot changed as a result of a Municipal Planning Strategy. The Municipal Planning Strategy took eight years to complete and was widely advertised in the area. Licensees are deemed to be knowledgeable professionals and ought to have been aware of the changes to the Land Use By-law in their practice area.

When listing a property, licensees have an obligation to discover all facts pertaining to the property, this includes taking all reasonable steps to verify information that is relayed to them by their clients. Being an approved building lot is a significant selling feature for a piece of land. The seller’s licensee had an obligation to verify this information prior to advertising. This advertisement was misleading to the public and did not protect their clients’ best interests.

The licensee was charged with and agreed to having violated Commission By-law 702, Article 10 for failing to verify this information.

PENALTY

The licensee was fined $500 for the violation.

CASE #2: NOT PROTECTING INTERESTS OF CLIENTS AND UNPROFESSIONAL CONDUCT

A seller planned to list their property with a licensee. Two days prior to the intended list date, the licensee asked the seller if they would be agreeable to the licensee promoting the upcoming listing internally amongst licensees at their brokerage. The seller agreed. The brokerage practices designated agency. This resulted in one viewing request from another licensee at the brokerage. The seller consented to the viewing. The following day, the seller proceeded to list their property for sale. After listing the property, the seller stated their licensee advised them that the viewing resulted in an offer. The seller submitted a complaint to the Commission alleging that the offer was not provided to them during the open for acceptance time. The seller further alleged that the licensee negotiated on their behalf, without their knowledge or consent, by advising the buyer’s licensee they did not accept the offer and may request a revised offer later.

The seller’s licensee stated that they had advised the seller that the viewing would likely result in an offer but they were traveling and could not present the offer until the following day. The seller stated they were not advised of this information. The offer in question was prepared the evening of the viewing and was open for acceptance until 9:00 a.m. the following morning. The seller’s licensee and buyer’s licensee discussed the offer via text message after it was received by the seller’s licensee. At this point, although the licensee was acting in an agency capacity, the seller had not signed a Working with the Real Estate Industry disclosure form or Seller Designated Brokerage Agreement.

The evidence supported there was a phone call between the seller and their licensee at 9:12 a.m. the follow morning, after the offer expired. The licensee states during this phone call they advised the seller of the offer and the seller decided not to counter the offer and to proceed with listing the property. The seller denied being advised of the offer until later in the day and stated the only discussion during this phone call was about listing the property. Since the phone call was verbal there is no way to substantiate what was said during the phone call. The evidence did support that the seller’s licensee did not provide the seller with a copy of the offer during the open for acceptance time. This did not protect the seller’s interest and was a violation of Commission By-law 702, Article 2.

The evidence did not support that the seller’s licensee negotiated on the buyer’s behalf with the buyer’s licensee.

Unrelated to the allegations, the investigation included a complete review of the brokerage transaction file. The evidence supported the seller’s licensee acted in an agency capacity for the seller without first having them review and sign a Working with the Real Estate Industry disclosure form and a Seller Designated Brokerage Agreement. There is an order of operations that must be followed by licensees with respect to relationship disclosures, agency/customer agreements, and agreements of purchase and sale. The industry has been well informed and educated on this required order of operations. The licensee’s conduct was unprofessional and constituted a violation of Real Estate Trading Act, Section 22 (1) (a).

In addition, it was in the seller’s best interests to expose their property to the market and solicit as many offers as possible. Only promoting the property amongst the brokerage prior to listing did not protect the seller’s interests, a second violation of Commission By-law 702, Article 2.

The seller’s licensee was charged with, and agreed to having violated, two counts of Commission By-law 702, Article 2 for not acting in the best interests of their client; and Real Estate Trading Act, Section 22 (1) (a) for unprofessional conduct regarding agency disclosure/agreements.

PENALTY

Yasser Khalaf, salesperson with Re/Max Nova, was fined $500 for each violation of Commission By-law 702, Article 2 and $1,000 for the violation of Real Estate Trading Act, Section 22 (1) (a).

CASE #3: MISLEADING ADVERTISING/FAILURE TO DISCOVER FACTS

Buyers purchased a residential home on a corner lot and an adjacent lot. The adjacent lot was advertised as 3,000 square feet and included a picture of the lot. The buyers planned to build a shed on the adjacent lot. After closing, the buyers discovered the lot was only 1,500 square feet and that the picture included in the advertisement was actually of a different lot on a different street. The buyers submitted a complaint to the Commission alleging that the seller’s licensee misrepresented the lot in the advertisement both in the square footage and the picture. They further alleged that their licensee did not provide them with the Property Online information prior to closing and did not verify the PIDs they were purchasing.

The seller’s licensee stated that they were misinformed by the seller regarding which additional lot they owned and took a picture of the incorrect lot. The licensee later verified the correct lot on Property Online, but mistakenly uploaded the picture of the incorrect lot, therefore misrepresenting which lot was for sale.

At the time of listing, Property Online identified the lot as 3,000 square feet. The square footage changed to 1,500 square feet as a result of the migration process and the evidence did not support that either licensee was notified of this information prior to closing.

The evidence supported that although the buyer’s licensee prepared an offer with two PIDs, they did not have a conversation with the buyers about the additional lot they were purchasing, they were not aware of the location of the additional lot, and did not attempt to discover the boundaries. Licensees have an obligation to discover facts pertaining to properties. This includes providing consumers with all information from Property Online, which in this case, the evidence supports the buyer’s licensee did not do.

Unrelated to the allegations, the investigation included a complete review of the brokerage transaction file. Both licensees were issued a written warning for paperwork discrepancies.

The seller’s licensee was charged and agreed to having violated Commission By-law 708 (a) (i), (ii) and (iii) for misrepresenting which additional lot was for sale.

The buyer’s licensee was charged with and agreed to having violated Commission By-law 702, Article 10 for failing to discover facts.

PENALTY

Both licensees were fined $500 for the violations.

CASE #4: RELEASING DEPOSIT WITHOUT WRITTEN AUTHORITY

As a result of information brought to the Commission’s attention by a consumer, the Registrar initiated an investigation against a broker.

The brokerage was representing a buyer in a transaction and the seller was a customer of the brokerage. The buyer was paying remuneration to the brokerage. Per the terms of the Agreement of Purchase and Sale, the deposit was held in the brokerage’s trust account. Upon closing, the broker removed the funds from the trust account to be credited toward the brokerage’s remuneration. This resulted in the seller’s lawyer not having all funds required to close because they were short the amount of the deposit.

Clause 1.1 of the Agreement of Purchase and Sale identifies that deposits are to be held in trust by the brokerage pending completion or termination and are to be credited towards the purchase price on completion.

In situations where a Seller Brokerage Agreement/Fee Agreement is in place and the seller is paying remuneration, these agreements contain a clause in which the seller authorizes the brokerage to apply the deposit towards any remuneration owed to the brokerage. This process does not apply when there is a Buyer Brokerage Agreement in place and the buyer is paying remuneration. The Buyer Brokerage Agreement cannot give this direction because clause 1.1 states the deposit is to be applied towards the purchase price, which is always paid to the seller.

The broker ought to have known that written authority (by way of an amendment to clause 1.1 of the Agreement of Purchase and Sale or written direction from the respective lawyers) was required from both parties in order to apply the trust deposit toward remuneration.

The broker was charged with and agreed to having violated Real Estate Trading Act, Section 22 (2) (a) for applying the trust deposit towards remuneration, without having written direction from all parties.

PENALTY

The broker was fined $500 for the violation.

CASE #5: NOT MAKING REQUIRED DISCLOSURES

A few years after purchasing a residential home, buyers discovered that their deck and pool were located partially on top of the septic system. The buyer’s stated that their licensee confirmed the location of the septic system prior to closing to ensure it was located away from the pool. They submitted a complaint to the Commission citing numerous allegations against the seller’s licensee, who was also an owner of the property. They alleged the seller’s licensee misled their licensee concerning the location of the septic system and failed to disclose other information to them, including that the property was a matrimonial home.

Any conversations between the buyer’s licensee and seller’s licensee concerning the location of the septic system were verbal, therefore there was insufficient evidence to determine whether seller’s licensee misled the buyer’s licensee regarding the location of the septic system. The buyers did not complete an inspection of the septic system.

The seller’s licensee was required to notify the buyer in writing prior to the Agreement of Purchase and Sale or within the agreement itself that they are licensed and that the property was a matrimonial home. They did not make the required disclosures and as a result violated Commission By-law 702, Article 21.

PENALTY

The licensee was fined $500 for the violation.

Case #6: Lack of Knowledge/Skill/Judgement and Failure to Discover Facts

Out-of-province buyers found a licensee to assist them in finding a retirement home in Nova Scotia. The buyers made three offers in total on two different properties that were listed with the licensee. Their third offer was accepted and subsequently closed. The buyers were customers of the brokerage. After closing, the buyers submitted a complaint to the Commission alleging that the licensee did not discuss agency relationships with them. They believed the licensee was acting in their best interests. They further alleged that the licensee misinformed them by advising that they would not be responsible for road maintenance.

Prior to offering on the subject property, the buyers were interested in a different property that was listed by another brokerage. The licensee contacted the listing licensee on the buyer’s behalf and provided them with advice without first having the buyers sign a Working with the Real Estate Industry (WWREI) disclosure form or a Buyer Designated Brokerage Agreement (BDBA).

The same day, the licensee prepared the buyer’s first offer on the subject property and provided them with all pre-prepared documentation to be signed, WWREI, Buyer Customer Acknowledgement and Agreement of Purchase and Sale.

In addition, the evidence supported that the licensee continually convoluted their role as the seller’s representative in this transaction. Despite having the buyers sign three separate Buyer Customer Acknowledgements, the licensee proceeded to provide them with advice, supporting that she was acting in the capacity of implied agency. Convoluting their agency role and the above paperwork discrepancies constituted a violation of Real Estate Trading Act, Section 22 (2) (a).

The buyers stated the licensee verbally advised them that the municipality, and later the department of highways, were responsible for the road maintenance. Upon closing they discovered the road is private and they are responsible for road maintenance. There was insufficient evidence to support what the licensee advised them regarding the road maintenance; however, it was easy to determine the road is private on Property Online. The licensee thought the road was public. By failing to discover this fact the licensee violated Commission By-law 702, Article 10.

In addition, the evidence supported that the licensee did not discover that the subject property was a matrimonial home. Prior to entering into brokerage agreements with sellers, licensees are required to verify who has the authority to market and sell the property and ensure all sellers are identified on and sign all real estate documentation. The licensee was issued a written warning on this.

The licensee was charged with and agreed to having violated Real Estate Trading Act, Section 22 (2) (a) for paperwork discrepancies and convoluting their agency role with the buyers, and Commission By-law 702, Article 10 for failing to discover the subject property was located on a private road.

PENALTY

Andrea Huskilson-Townsend, salesperson with Keller Williams Select Realty, was fined $1,200 for the violations.

Case #7: Unprofessional Conduct During A Viewing

The Commission received a complaint from members of the public whose property was listed for sale. Their complaint was against a licensee who facilitated a virtual viewing of the property for a buyer. They alleged that without their knowledge or consent, the licensee recorded the viewing, in which they made derogatory comments about the property, and uploaded the recording to YouTube, open to the public. They further alleged that the licensee brought a building inspector, who was the licensee’s spouse, to the property without their consent.

The evidence supported that the licensee recorded a virtual viewing with a buyer and uploaded the recording to YouTube, open for the pubic to view. The evidence further supported that at the time this complaint was received, there were numerous recordings of other virtual viewings uploaded to the licensee’s YouTube page in public view. The licensee stated they meant to only have the recordings under a private link for buyers to view.

Licensees must have consent from the sellers in order to record viewings. Without consent from sellers, taking a video in a property is not permitted and constitutes unprofessional conduct. The public must have confidence that when they provide access to their property to real estate licensees, that their privacy will be respected and information shall be gathered, used, and shared, only for a reason related to trading in real estate.

In addition, the evidence supported that the licensee brought their spouse, an unlicensed person, to numerous viewings and left them unattended both inside and outside of properties. Licensees have a professional responsibility to ensure that attendees at viewings are appropriately supervised. Failing to follow this protocol constituted unprofessional conduct.

The licensee was charged with and agreed to having violated two counts of Commission By-law 702, Article 35, for unprofessional conduct.

PENALTY

The licensee was fined $500 for each violation.

Case #8: Not Protecting Interests of Client

A buyer purchased a residential home and believed that specific fixtures/chattels, including uninstalled baseboard heaters, would be left by the seller. The items were not left at the property on closing. The buyer submitted a complaint to the Commission against both their licensee and the seller’s licensee alleging that both licensees were unclear with regards to what fixtures/chattels would remain at closing. The buyer additionally alleged that the seller’s licensee fabricated statements regarding items the sellers would leave in the property.

The evidence supported that the buyer’s licensee inquired to the seller’s licensee about specific items that the buyer wanted to remain at the property. The seller’s licensee provided them with a list of items the seller would leave at the property. The items desired by the buyer were not included on the list. The buyer’s licensee did not ensure the items were added to the list or prepare an amendment to the Agreement of Purchase and Sale to ensure the items desired by the buyer would be left. This did not protect the interests of their client.

The evidence did not support that the seller’s licensee failed to clearly articulate what fixtures/chattels would remain on closing or that they fabricated statements regarding items that would be left. The seller’s licensee confirmed all information concerning fixtures/chattels with the sellers and provided this information to the buyer’s licensee.

Unrelated to the allegations, the investigation included a complete review of the brokerage transaction file. Both licensees were issued a written warning for paperwork discrepancies.

The buyer’s licensee was charged and agreed with having violated Commission By-law 702, Article 2, for not protecting the interests of their client.

PENALTY

The licensee was fined $500 for the violation.

Commission Initiated Investigations per Real Estate Trading Act Section 17(2)

Case #1: Undisclosed Criminal Charges/Convictions

A consumer contacted the Commission alleging that a licensee had been charged with a DUI and assault. The Registrar reached out to the licensee to confirm whether they had been charged and/or convicted of any criminal offenses. The licensee confirmed the information. Since the licensee did not disclose this information to the Registrar, as required, the Registrar initiated an investigation against them.

The evidence supported that the licensee was charged and convicted of criminal offenses. The licensee mistakenly thought they were only required to disclose this information when a conviction had occurred. The licensee further believed they had until renewal time to disclose this information. Commission By-law 410 (f) requires that all licensees disclose criminal charges and or convictions to the Registrar in writing immediately upon occurrence.

The licensee was charged and agreed to having violated Commission By-law 410 (f) for not disclosing criminal charges and convictions to the Registrar immediately upon occurrence.

PENALTY

The licensee was fined $500 for the violation.

Case #2: Misleading Advertising

It was brought to the attention of the Commission that an unlicensed company was promoting itself as a licensed real estate brokerage on a website. The Commission determined that the website belonged to a licensee. It appeared that the company was a property management company that was also promoting real estate trading. Upon further review, the Commission discovered the licensee was also operating another similar website. As a result, the Registrar initiated an investigation against the licensee.

It was determined the licensee owned an unlicensed company that was registered with Nova Scotia Registry of Joint Stocks. The company offered non-trading services such as residential property management. Both websites operated by the licensee promoted real estate trading services offered by a team. The licensee was the only person licensed to trade in real estate on the referenced team and therefore the team did not meet the By-law definition. The By-law requires that a team have a minimum of two licensees with the same brokerage.

Both websites identified the brokerage name but it was in small font and therefore was not depicted prominently.

Licensees are not prohibited from having other occupations; such as owning an unlicensed company, however; when trading in real estate, licensees are trading on behalf of the licensed brokerage and this must be clear to consumers. The websites in question were convoluted and misleading to consumers as to who the licensed brokerage/persons were and what services they were offering. Further, the office address being promoted on the website was not licensed as a branch office with the Commission.

The licensee was charged and agreed to having violated Real Estate Trading Act, Section 4 (1) for advertising and promoting real estate trading services from an unlicensed brokerage; and Commission By-law, 708 (a) (i), (ii) and (iii) for false and misleading advertising regarding an unlicensed branch office. The licensee was also issued warnings for advertising a team that did not comply with NSREC By-law 144A, promoting real estate trading services, prompting consumers to contact an unlicensed person via email, and for not identifying the brokerage name on various social media accounts.

PENALTY

The licensee was fined $500 for each violation.

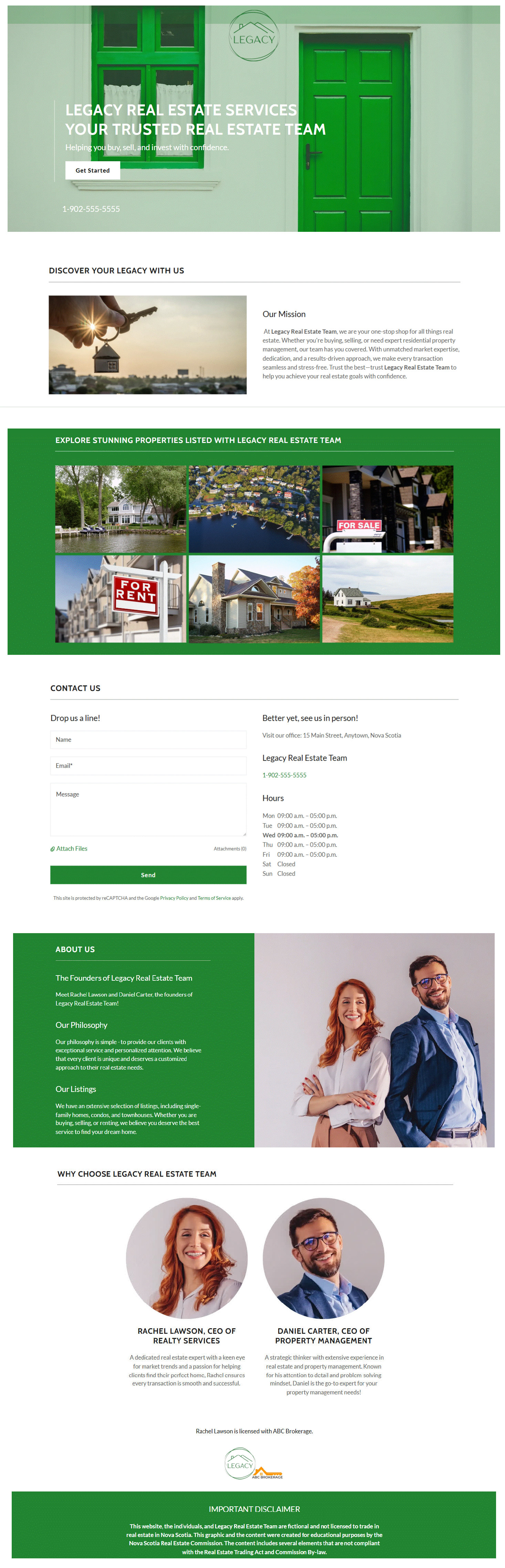

For educational purposes, the Commission has created a fictional website graphic to better explain the issues with the website in this case. Please note that this website, brokerage, "team", and the individuals pictured below are fictional and not licensed to trade in real estate in the province of Nova Scotia.

The website for the fictional "Legacy Real Estate Team" includes the following issues, similar to those in the real disciplinary investigation:

- Misleading promotion of an unlicensed brokerage (Legacy Real Estate Services.)

- The actual Brokerage name is not prominent.

- The "Legacy Real Estate Team" does not comply with the By-law's definition of a team as only one person is licensed. Further, it is not clear who is licensed. Daniel must be identified as not licensed.

- The team is offering services that are not a trade in real estate-without qualifying.

- The branch office advertising is unlicensed.

- The team logo is larger than the Brokerage logo.