Conduct & Trade Practices FAQs

Have you ever had a "How do you..." question when it comes to trading in real estate? Here you will find a growing list of frequently asked questions related to conduct & trade practices.

Is there a question you have that is unanswered here? This email address is being protected from spambots. You need JavaScript enabled to view it.

(a) If a brokerage or a designated agent in an agency relationship with a seller receives a competing offer or offers, the brokerage or the designated agent must follow the direction of the seller as to whether to disclose to every person who is making one of the offers:

(i) that there are competing offers; and/or

(b) The brokerage or designated agent must not disclose the contents of any offer.

Whether to disclose a multiple-offer situation to respective buyers is entirely up to the seller. The decision on whether to disclose is documented in clause 8 of the Seller Designated Brokerage Agreement or clause 6 of the Seller Brokerage Agreement. The seller's licensee must follow the seller’s lawful instructions.When there are multiple offers, a licensee acting on behalf of the seller must disclose to all competing buyers or their agents that there are multiple offers, unless otherwise instructed by the seller in writing, but must not disclose to any other person the specific terms and conditions of other offers.

Adding a Second Buyer to an APS

STEP TWO: Complete an amendment to the APS, adding the new buyer. The following clauses for the amendment clearly outline the addition of the new buyer (insert the individual’s name where the clauses reference [new party]): “a. [New party] is entering into the amendment to become a party to the agreement of purchase and sale (“the Agreement”) dated* the [date] day of [month] between [name of originally listed buyer] as buyer and [name(s) of seller(s)] as seller. The Agreement and the existing parties to the Agreement are entering into this amendment to accept the [new party] being added to the Agreement as buyer; and” “b. [New party] confirms their acceptance of all of the terms of the Agreement. *Date refers to the date of acceptance.

STEP THREE: The added buyer and all of the original parties must all sign the amendment to the APS consenting to the additional buyer being added.

STEP FOUR: (Optional) Have the added buyer initial and date the bottom of each page of a copy of the original APS, the PDS, the Schedule of Leased/ Rented Equipment and any other relevant real estate documents, as evidence that the new buyer clearly read and understood all terms.Advertising a Property as 'Coming Soon'

The Commission does not have a mandatory form to offer 'Coming Soon' advertising to a seller, however Brokerages may create their own. Any agreement that is used for this purpose must include:

All ‘Coming Soon’ advertisements, whether it is a social media post, a lawn sign or an online ad, must include the following:

(August 14, 2020) Reminder: The use of 'Coming Soon' advertisements is for advertising properties that have not been listed. Next time you take to advertising on social media to highlight an anticipated future listing, have your broker review the ad and take a moment to ensure what you are displaying meets the Commission's Board of Director's approved policy setting minimum standards for 'Coming Soon' advertising and promotions. View the full policy HERE.Advertising Sold Prices Reminder

After the transaction has closed, the buyer's broker only needs the buyer's written permission to advertise the sale. The advertisement must clearly state the brokerage represented the buyer only in the transaction. This written permission must advise what they are advertising and an expiry date.

Advertising purchase price by buyer's or seller's brokerage: In order to advertise purchase price information, you need written permission from both parties to an agreement of purchase and sale (buyer(s) and seller(s)). This permission must advise what they are advertising and an expiry date. Note, advertising a purchase price includes the practice of stating the property sold for $X amount over list or asking price.Calculating the Number of Pages in an Agreement of Purchase and Sale

What isn’t included in this page number and does not form part of the Agreement of Purchase and Sale? Some examples are: a Counter Offer, Property Condition Disclosure Statement or a Transaction Brokerage Agreement.Clause 12 (Agency Relationship) in Form 400: Agreement of Purchase and Sale

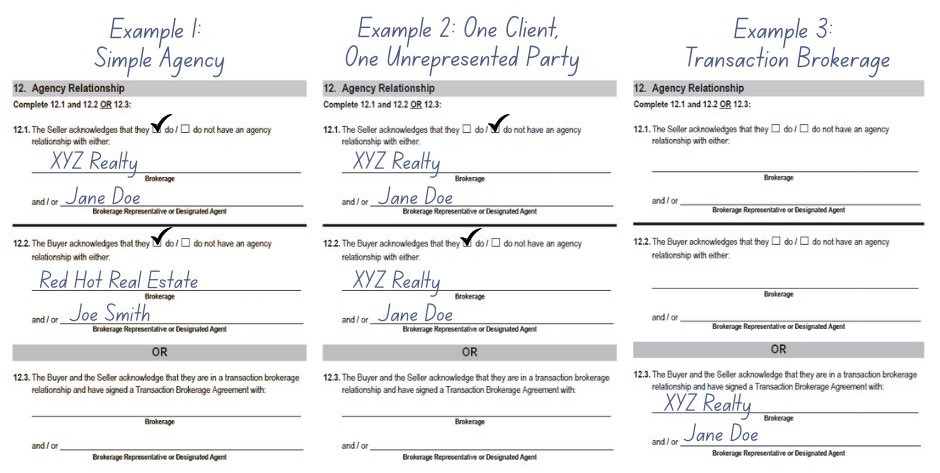

Example 1: Simple Agency. The seller is represented by one brokerage and the buyer is represented by another brokerage. Each party has their own independent representation.

Example 2: One Client, One Unrepresented Party. One party is in an agency relationship with the brokerage/designated agent, and the other is unrepresented. The example demonstrated a buyer client and unrepresented seller. For a seller client and unrepresented buyer, the clause would be filled out the same but with the opposite check mark boxes used.

Example 3: Transaction Brokerage. When an offer is submitted after the parties have entered into transaction brokerage, clause 12.3 would be completed, instead of 12.1 and 12.2.

Competing Offers

Completing the Brokerage Representative line

When using WebForms, you may encounter instances where it automatically inserts industry members names into that line. In this instance, delete the inserted text and physically sign the line when filling out the form.Completing the Remuneration Clause in the Buyer (Designated) Brokerage Agreement

If that amount is unclear at the time the brokerage agreement is completed, or if the remuneration changes prior to the facilitation of an offer (i.e. a range to a set fee), the brokerage agreement must be amended to reflect the accurate remuneration once that remuneration amount is known.Drone Operating Requirements

The Greenwood control zone (surface to 5000 feet above ground level) extends to 7 nautical miles (approximately 13 km) from the centre of the airfield. Any drone operator wanting to operate their drone in this area needs to get prior permission from 14 Wing Operations (902-765-1494 ext. 5457), and be in contact with the Air Traffic Control tower while doing their flight.Duties unlicensed employees at the brokerage CANNOT do

In real estate transactions…

In working with real estate licensees…

Escalation Clauses Do Not Comply With the Act

Excess Trust Deposits

When using the Commission’s Agreement of Purchase and Sale, the Buyer and Seller consent to the early release of excess trust funds in clause 1.3 of the Agreement. Clause 1.3 states:

When NOT using the Commission’s Agreement of Purchase and Sale, and the Seller or their Lawyer requests excess trust funds prior to closing:

Useful Information

When not using the Commission’s Agreement of Purchase and Sale and the broker holding the funds requires written mutual consent (an Amendment), refer to the clause book which includes a clause that can be used in excess trust deposit situations.

Extending a Contract

The compliance inspectors, through the course of inspecting transaction files, have seen instances where brokerage agreements were amended to extend the length of the contract, but the amendments were created and signed after the original seller brokerage agreements expired. This is just plain wrong. When a contract expires, it ceases to exist. And, you cannot amend something that no longer exists.Multiple (Competing) Offer Situations & Confidentiality

(ii) the number of competing offers.

Should a seller change their mind regarding whether to disclose that there are multiple offers, the Brokerage Agreement must be amended accordingly.

In summary, if you are the seller's licensee and have received multiple offers and have instruction to disclose to competing buyers:

For example, do not disclose:

These are all violations of by-law 737.Remuneration for Teams

The licensees with the brokerage are not parties to any contracts entered into between them on behalf of the brokerage and the consumers who have engaged the brokerage services. A review of applicable case law also demonstrated that licensees are only entitled to compensation from the brokerage with which they are licensed.

Reviewing of Offers (Including Pre-emptive Offers)

A pre-emptive offer (also known as “bully offer”) is an offer that expires prior to the date specified by the seller. Regardless of the date set by the seller, the seller can choose to review the pre-emptive offer and accept, reject, counter, or not respond. Likewise, the seller can, at any time, accept, reject, or counter any other offer received.

The seller’s licensee is to ensure their client’s interests are protected and to advise them of the possible implications when considering acceptance of any offer prior to the date set by the seller. If there is a lot of interest, it may be best for the seller to wait until that set date.

If a seller receives a pre-emptive offer, they are not obligated to wait to have showings and additional offers. The seller can decide how and when they want to receive offers. If a seller wants to review a pre-emptive offer, they can direct their licensee to amend the Brokerage Agreement to include pre-emptive offers.

There is nothing restricting the buyer’s licensee from submitting a pre-emptive offer on behalf of their client; however the buyer’s licensee is to ensure their client’s interests are protected.

Buyers must be aware that a seller can decide to ignore any offer, including a pre-emptive offer, that is submitted for their property. Further, a buyer who submits a pre-emptive offer may provoke a negative reaction from the seller because it does not follow the seller's offer instructions.

The Commission By-law outlines the obligations that licensees are required to fulfill as part of their agency relationship with either a buyer or a seller, including: promoting the interests of their client, obeying all lawful instructions, assisting in negotiating favourable terms and conditions, and presenting all offers or counter-offers in a timely manner.Satisfying Buyer's Conditions

For more information on Form 408 and satisfying buyer's conditions, click HERE.

Key things to remember:

Stigmatized Properties

Buyers may have specific areas of concern that would cause them to avoid a property that does not include cosmetic or structural issues. These intangible attributes to a property may cause it to be considered “stigmatized,” meaning it has had a traumatic or horrific circumstance occur in or near it, but does not specifically effect the appearance or function of the property itself.

See our full article on how to deal with stigmatized properties here.Striking Clauses (Dos and Don'ts)

Submitting Offers on Multiple Properties At The Same Time

A licensee that engages in this practice is in violation of the Act (specifically section 22(1)) and the By-law.

When submitting an offer to a seller, the buyer is representing that they will enter into an agreement in good faith if their offer is accepted. A licensee submitting multiple offers on behalf of a client (unless their client is willing to purchase multiple properties) knows that at least some of the offers being made are not being made in good faith as there is no intention to purchase all of the properties. The fact that at the time the offers are submitted it is unclear which of the multiple offers is not made in good faith does not change the licensee’s knowledge that the buyer does not intend to be bound by one or more of the offers.

If a buyer wants to use this strategy, you must advise them that this is not a lawful instruction and violates the Act and the By-law.Taking Contracts with you when Changing Brokerages

Using Electronic Signatures

If the brokerage chooses to make an electronic signature service available to their clients, the brokerage must retain copies of all signed agreements and acknowledgements (i.e. Certificate of Authenticity) which includes the e-signature of a client or customer of the brokerage. These certificates can be retained in either hardcopy or saved electronically at the brokerage. It is not necessary for the brokerage to retain certificates from cooperating brokerages provided it is agreed that it represents a legal signature.

For more information, see our Common Errors when using Electronic Signatures

Electronic Signatures Require Time Stamps

(May 18, 2022) Reminder to licensees that when submitting an offer to purchase or sell real estate, all signatures require the date of acceptance per section 30(2) of the Real Estate Trading Act. If using an electronic signature platform that does not reflect the date of acceptance, it is required to maintain a certificate supporting the date of accepting/signing the document.What is Considered a Bedroom

Seller's licensees must confirm the building codes for bedrooms with the respective municipality when listing properties. Houses with bedrooms that are not to code can be advertised as bedrooms; however, the advertisements must clearly indicate the bedrooms do not comply with building codes and state why, for example, window too small to allow egress.

Buyer’s licensees also have an obligation to discover facts when representing clients. If a bedroom appears to have a window that does not pass code, they are to bring it to their attention of their client and recommend they confirm with the municipality.